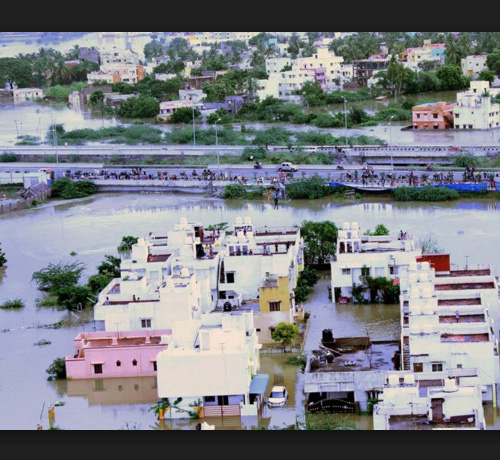

Article - Floods maroon Chennai, but few opt for calamity insurance

Back to All Insurance Articles and News

22 Dec 2015Queries and web traffic rises on insurance websites when any major catastrophe strikes, but very fewend up buying insurance products, resulting in a conversion ratio of just 10-15%.

Reacting to the Chennai floods, hundreds are rushing to general insurance companies and ringing in call centres to enquire about insurance products. But very few of them would buy any product.

“The company has witnessed a moderate hike in queries for home, fire or health insurance through the web or call centres post the floods in Chennai,” says Sasikumar Adidamu, chief technical officer, non-motor, Bajaj Allianz General Insurance. Another insurer confirms this trend. “During the period of an event like the Chennai floods there is a spike in enquiries and the website traffic is high,” says Gunjan Ghai, senior vice-president and national head, branding & marketing and product development at SBI General Insurance.

And these enquiries aren’t just from the location which witnessed the calamity.

“Typically, most of these queries are either from the same location or from region that resembles the topography of catastrophic region. For instance, after Chennai floods we recorded an increase in the number of queries around home insurance not just from Chennai but also from other coastal areas as well as from Mumbai,” says Yashish Dahiya – CEO & co-founder, Policybazaar.com.

On type of products people enquired about, Dahiya said, “Apart from home insurance, car insurance and fire and dwelling products, queries regarding engine protector add-on cover have gone up.”

In fact, zero-depreciation add-on cover too has been seeing tremendous demand. “I cannot confirm whether the trend is related to catastrophes, but over a period demand for add-on covers such as zero depreciation has been strong,” says Ghai.

In some pockets insurance wasn’t on individuals’ mind when the calamity struck. It was only after some action by the companies that they reacted. “We have received most queries after SMSes were sent out to customers encouraging them to avail home insurance after the city witnessed flooding and inundation,” says Adidamu.

Low conversions

Though insurers get enquiries regarding products immediately after a disaster, they don’t translate into purchase. As days pass, enquiries taper down and resurface when there is another similar event.

“After an event people get worried and think about insurance, but that doesn’t result in actual purchase unless it is happening in their neighbourhood. The number of calls wither off in a month,” said Ghai.

Adidamu seconds: “Most of these queries do not result in actual purchase and peter out as time passes.”

According to policybazaar.com, insurance companies have been able to convert roughly around 15% of queries during such mishaps. “While such incidences influences people to consider opting for related insurance policies, it does not have a lasting impact on them and hence, it does not usually go beyond the ‘contemplation’ stage,” enunciates Dahiya.

This is after a year which saw the highest number of catastrophes (189 in 2014) globally as indicated in the reinsurer Swiss Re’s SIGMA study released in March 2015. Even then the conversion ratio of calls after catastrophes is pegged at hardly 10%, as per B K Sinha, MD of Unison Insurance Brokers.

High economic losses

No wonder then that the insurance claims are abysmally low. The AON Benfield Catastrophe Recap report of November 2015 estimates Chennai floods economic losses to exceed Rs 20,000 crore, while the insurance claims are anticipated to be in the range of a meagre Rs 2,000 crore. The gap was wide enough during previous events too.

The Chennai floods saw several motor insurance claims, but hardly any for home insurance. M Ravichandran, president - insurance, TATA AIG General Insurance, points out, “Maximum number of claims have been received for automobiles (cars and two wheelers) followed by small business units, telecom towers and ATMs.”

Victims increase coverage

An emerging trend that insurers observe is that calamities force those who are affected to buy covers and the victims who have covers to enhance the sum assured. “After the J&K floods last year, many who were insured were seen enhancing their covers to avoid underinsurance in the future; however, most who were uninsured continued to remain without an insurance cover,” says Adidamu.

Another strange behaviour is observed. “Commercial risks are generally insured against fire risks either because they are financed by banks or financial institution or are owned by corporates,” points Easwara Narayanan, chief operating officer, Future Generali India Insurance Co. But insurers are quick to add that even the entrepreneurs and SMEs who insure their commercial places fail to buy a cover for their residence or valuables.

Why low conversion?

But why don’t people buy covers after they have shown interest? There are varied reasons that experts point out. “Unless someone sees their neighbour or a related person being paid they wouldn’t see value in insurance,” Ghai observes.

Source: dnaindia

About Navnit Insurance Broking Private Limited

Navnit Insurance Broking relationship with our customers lies at the heart of our business philosophy. We believe in understanding their needs and becoming their valued partners and advisors, committed to meeting their requirements at every stage of their lives.